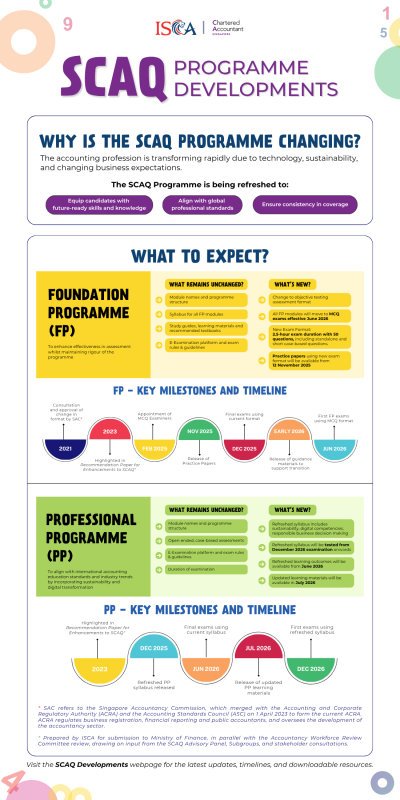

From June 2026, all Foundation Programme (FP) modules will adopt an objective testing assessment format using Multiple-Choice Question (MCQ) exams, providing a more consistent and accessible assessment experience.

0 Lessons

Note: This set of recorded webinars is not part of the complimentary learning support package for SCAQ candidates and requires separate enrolment.

6 Lessons

Note: This set of recorded webinars is not part of the complimentary learning support package for SCAQ candidates and requires separate enrolment.

6 Lessons

Note: This set of recorded webinars is not part of the complimentary learning support package for SCAQ candidates and requires separate enrolment.

6 Lessons

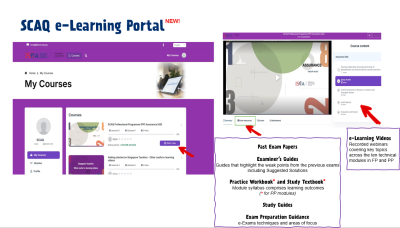

SCAQ e-Learning Portal - Instructional Video User Guide

0 Lessons

1 Lessons

These resources are provided by the Inland Revenue Authority of Singapore (IRAS) and are intended for public education on tax obligations and tax laws in Singapore. They are excellent resources that offer a foundational understanding of Singapore taxation and an ideal starting point for exploring various topics in Singapore taxation syllabus.

0 Lessons

Please refer to the official IRAS website https://www.iras.gov.sg for updates on Singapore’s annual Budget, legislative changes, relevant tax periods, and any other recent developments that may impact tax obligations and compliance.

3 Lessons

5 Lessons